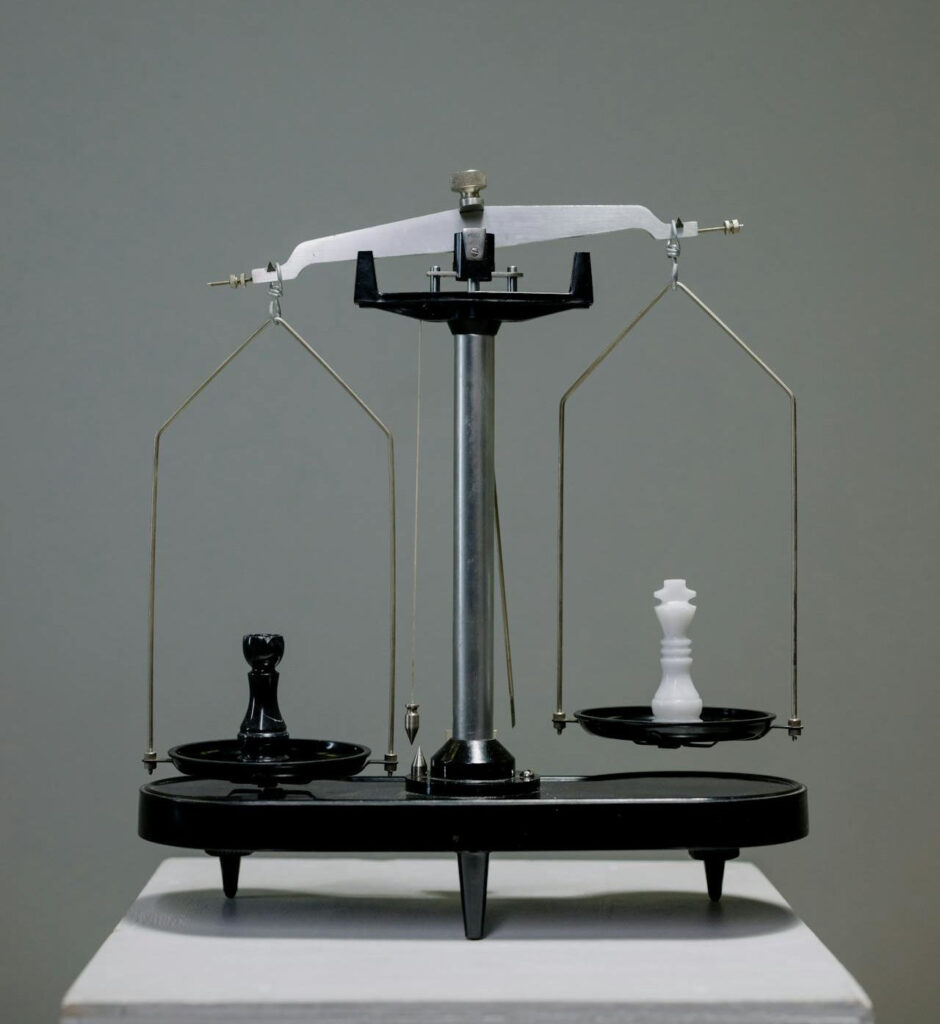

The delicate balance of premium rating and loyalty

In the intricate world of insurance, partnerships are the backbone upon which success is built. At the heart of these partnerships lie three crucial stakeholder: the insured, the broker, the insurer. However, maintaining harmonious relationship among these parties is not without it’s challenges, particularly when it comes to the delicate balance of premium rating and loyalty.

Striking the right balance

Effective communication is the cornerstone of any successful partnership. Whether conveyed verbally, visually or in writing, clear communication pathways are essential for mutual understanding and trust. Transparency and rapport between insurers and brokers not only instil confidence but also provide valuable knowledge that can be shared with clients, thereby minimising misunderstanding, and conflict.

Collaboration between brokers and insurers

However, in an industry characterised by constant change, the failure to communicate changes can have dire consequences. Collaboration between brokers and insurers is paramount, with brokers needing to be kept abreast of any adverse underwriting results or shift in industry trends. This collaborative spirit fosters adaptability, innovation, and resilience – qualities that are indispensable in navigating the ever-evolving insurance landscape.

Efficiency and effectiveness go hand in hand in driving future success. Striking a balance between the two ensures a steadfast focus on the insured and the end results, infusing confidence in insurers and propelling profitable growth. Embracing digitisation strengthens partnerships by streamlining processes and providing a competitive edge in the market.

Discovering that you could have secured an equivalent insurance product at a significantly lower price after years of loyal premium payments can evoke conflicting emotions. On the one hand, there’s elation at the prospect of saving money going forward. Yet, on the other hand, there’s a sense of frustration or even betrayal for having paid more than necessary for several years. This scenario underscores the growing attention given by international regulators to the issue of differential or margin pricing in insurance risk assessment and pricing strategies.

To read more click the button below and go to page 10.